What Does an EOB Statement Look Like?

EOB formatting will vary from insurance company, however all EOBs should contain the following information.

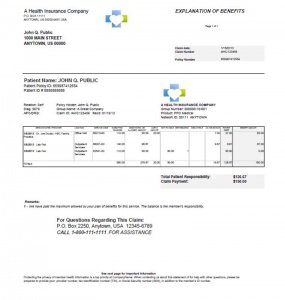

Each section of this sample EOB corresponds to the following explanations.

Enrollee Name and Policy Number: Identifies the policyholder. This is usually the name of the person who carries the insurance. For children, this would most likely reference the adult associated with the plan.

Enrollee Address: Indicates the address of the enrollee; this should be verified with each claim. A wrong address can cause problems in claims payment.

Patient Name and Patient ID #: Identifies the patient who was treated or received care and the identification number for the patient. This may be a member number or other unique identification number

Claim # and Date Processed: A number assigned by the insurance company to identify the claim in their computer system. The date indicates the time in which the claim (or revision) was processed by the insurance company and serves as a log of information that was available at this point in time.

Provider Name: Identifies the name of the doctor or hospital that is billing for the services. The reviewer should always verify this matches the care received, keeping in mind that some services are performed without face-to-face interaction with the patient (including lab work, radiology, in facility pharmacy, etc).

Service Details, including date and place of service: Indicates the date of when the service was rendered to the patient and the location the service was administered. The location can be important when reviewing as some services are only covered in specific locations.

Billing Code: This number represents and identifies the service performed specific to your diagnosis, the equipment used and even the type of facility where care was received. This code is universal within the healthcare and insurance industry but is very specific to the services you received. This will play an important role in the payment allowances. Note: Some insurance companies may only supply this information by request, however it is your right to this detailed summary with codes.

Charge Amount: Amount charged by the provider related to your care. This represents the normal fee that the provider has designated as appropriate for the services provided. Think of this as the retail price.

Allowed Amount: This is the amount pre-negotiated by your insurance company and its network of providers for the services you received. This amount also takes in to account what is referred to as “usual and customary” (UCR) charges and is impacted by geographic location of provider.

Not Covered: Amount that the insurance company has designated as not covered within your plan and therefore not eligible for payment. This may be an out of network provider, or a specific service that is outside of your plan benefits.

Reason Code & Description: Any adjustments made to the amounts listed in the bill will be reference here. If a service was denied, this provides explanation of why it was not covered within the plan specifics. Frequently more detail of these codes are within the footnotes or additional documentation of the EOB, if not described next to the code.

Deductible: This reflects the amount the patient must pay prior to having the benefits paid. Generally, each patient will have his or own deductible to meet according to the details in the plan. Some plans have different levels for in-network deductibles and out-of-network deductibles, and additional for pharmacy deductibles. Amounts that are not covered at all by your insurance plan are not applied to the deductible.

Co-Pay: This is the amount required from the patient when seeking services from a provider, and is described in the insurance plan language.

Benefit Amount / Payment Amount: This is the percentage or amount which the insurance company will pay the providers on your behalf. The amount paid will be determined by the schedule of benefits in your plan. Generally, participating and in-network providers will be paid higher percentage; non-participating providers will be paid a lower percentage of the entire bill.

Due from Patient / Patient Responsibility: This is the amount the patient is responsible for paying to the provider. This includes the copay amount, amount towards deductible, as well as any non-covered charges associated with your care.

Customer Service Contact information: This is the phone number and mailing address used to contact the customer service department of your insurance, should you have any questions or concerns related to this statement.

Relevant policies and procedures: This is an important section that outlines the procedures for additional follow-up related to your medical care and treatment and insurance reimbursement. Information regarding appeals is listed within this section, and are frequently time sensitive. The process for resubmitting claims is also identified.